Re-export trade: a method that can respond to

The US Department of Commerce is expected to make a final anti-dumping ruling on the products involved in the case on May 19, 2020. This case involves products under the U.S. coordinated tariff number 8305.20.0000.

In the anti-dumping investigation, the U.S. Department of Commerce ruled that all the companies involved in the case in Mainland China were exporting a large number of products involved in order to circumvent the preliminary anti-dumping ruling. Therefore, it decided that the provisional anti-dumping duties of the above rulings were retrospectively dated to the date of the preliminary ruling in the Federal Register. It will take effect for 90 days for the companies involved in the case in Mainland China that declare at the US Customs.

On June 27, 2019, the U.S. Department of Commerce announced the initiation of anti-dumping and anti-subsidy investigations on staples imported from mainland China, and an anti-dumping investigation on staples imported from South Korea and Taiwan. On July 19, 2019, the United States International Trade Commission (USITC) voted to make a positive preliminary ruling on anti-dumping and anti-subsidy industrial damage on staples imported from mainland China.

As high-quality and low-cost products made in China, they are often boycotted and investigated by industry associations or relevant ZF departments in the importing country because of their high quality and sufficient supply. Then it will be taxed with a corresponding amount of tax rate to offset the losses and impacts caused by the dumping of goods to the domestic industry.

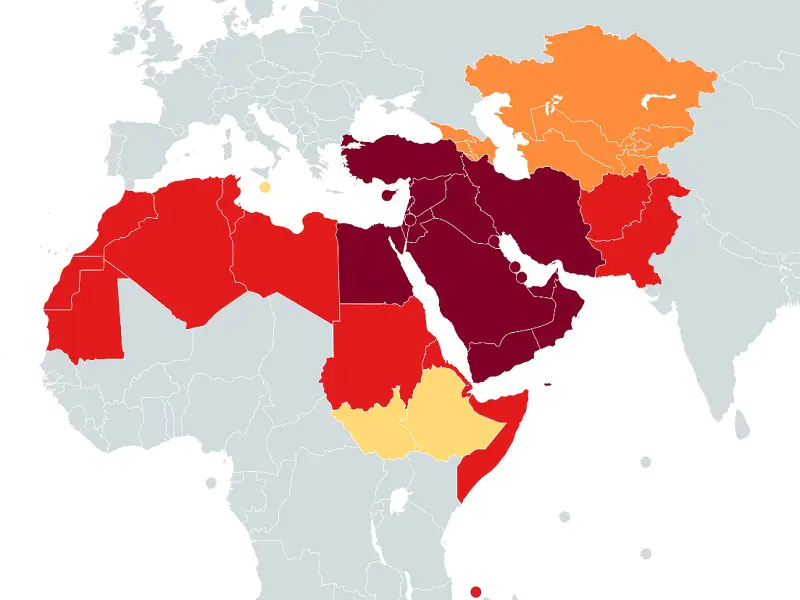

The United States, as the single country with the largest volume of trade with China, has long been subject to high anti-dumping measures for a wide range of products sold into the United States from China: furniture, mattresses, cabinets, bathroom cabinets, tiles and other categories. Tax, or countervailing duty. The purpose is also to prevent excessive Chinese goods from entering the US market.

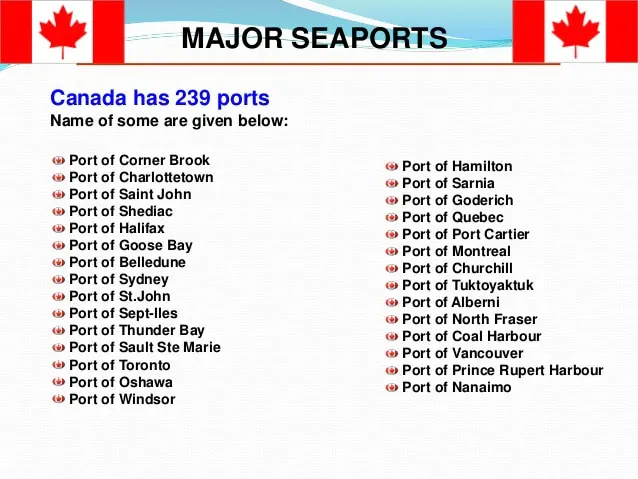

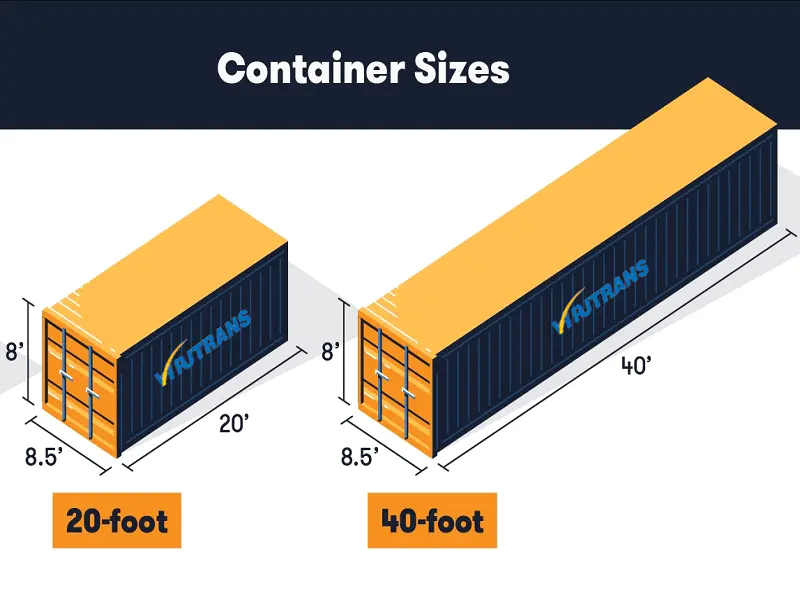

As for domestic enterprises in related industries, apart from moving to relevant third-party countries to build factories and re-establish the manufacturing system (the United States has extremely low tax rates for related products in this country, generally only a few points), re-export trade seems to have become a response. U.S. anti-dumping channels and methods are relatively quick and low-cost.

VIPUTRANS International Logistics, as a professional Sino-US dedicated line logistics makers, has a mature full set of re-export trade operating systems, processes and channels. In the course of many years of business practice, we have summarized a set of relatively complete and low-risk re-export trade methods. We have successfully provided companies such as mattresses, cabinets, bedroom furniture, etc., selling products to the United States at low tax rates, thereby avoiding Huge tariffs and fees.