Crisis of the Red Sea

-Container ship bypasses Suez Canal

Major shipping operators have suspended container traffic through the Suez Canal after Yemen's Houthi movement carried out multiple rocket attacks on Red Sea ships.

Paralysis of the Red Sea

More than two dozen attacks involving ships have been reported, most of them in the Bab el-Mandeb Strait, the border between the Arabian Peninsula and Africa.

Container ships such as the Maersk Gibraltar, Al Jasrah, Hapag-Lloyd and MSC Palatium III were all attacked.

In response to the attacks, MSC, Maersk, CMA CGM and Hapag-Lloyd decided to reroute container ships from the Suez Canal. This means that about 70% of container traffic in the Suez Canal has been suspended.

Alternative routes for container ships around Suez Canal

Due to the high-security risks in the Suez Canal, shipowners have been forced to choose alternative routes for their ships.

According to statements from the four companies, their container ships will take a longer but safer route around the Cape of Good Hope.

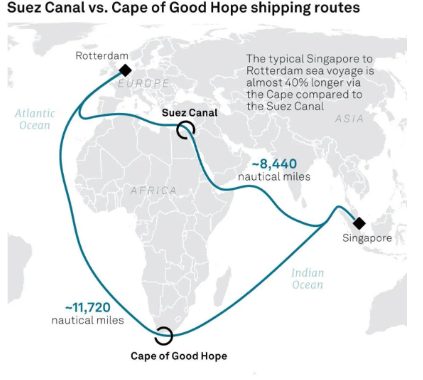

The new route could take 40% longer than the Suez Canal. This situation is bound to lead to delays in cargo delivery, and both shipowners and importers must be prepared.

Below is a comparison of the length of the route through the Suez Canal to the length of the route around the Cape of Good Hope as an example. The MSC said the delay would only last a few days. But in reality, they can be as long as ten days or so, and steadily increasing.

A comparison of the length of the route through the Suez Canal to the length of the route around the Cape of Good Hope

The MSC said the delay would only last a few days. But in reality, they can be as long as ten days or so, and steadily increasing.

Shipping companies need to consider both the time and cost implications when deciding between the Suez Canal and the longer route around the Cape of Good Hope. Factors such as fuel prices, vessel capacity, and the urgency of delivery play a significant role in determining the most suitable option for each specific voyage.

Consequences of the Suez Canal Blockade

The Suez Canal is a strategic waterway connecting the Mediterranean Sea and the Red Sea and plays an important role in global maritime transportation.

Its geographical location shortens transportation routes by thousands of kilometers compared to other routes, thus saving a lot of time and transportation costs.

The Suez Canal handles approximately 12% of world trade each year, transporting more than 50 billion tons of cargo.

Therefore, the blockade of the Suez Canal is not only related to the above-mentioned delays but also to the increase in the cost of organizing maritime transport.

Importers must be prepared to compromise between on-time delivery and higher shipping costs.

It will lead to serious disruptions in supply chains as well as end service systems.

Recently, affected by the Red Sea crisis, merchant ships from more than 10 major shipping companies around the world have avoided the Red Sea-Suez Canal and detoured to the Cape of Good Hope in Africa.

This has triggered concerns among companies about the safe delivery of goods. To ensure that goods can be delivered safely and on time, some companies have begun to use bypass, air transport, and combined sea and air transportation methods.

This change has brought new challenges to global logistics, which requires dealing with the risk of rising sea and air freight prices.

Quotations have been obtained for January, with the freight rate from China to the UK reaching US$10,000 per 40 feet. It’s surprising that a supply chain crisis would return in this way three years after the pandemic began.

It is also an indisputable fact that freight rates on European routes and Red Sea routes have increased several times. Alan Baer, CEO of logistics giant OL USA, pointed out that because ships need to turn in real-time to avoid the risk of attacks by Houthi armed forces in Yemen, ocean carriers have made rapid adjustments A quote was requested to cover the increased cost.

Compared with the changes during the epidemic, this time the adjustment is faster, and on some trade routes, freight rates have even increased by 100% to 300%.

According to data released by Kuehne + Nagel, as of Friday (December 22), 313 ships have been identified as being affected by the situation in the Red Sea. The total capacity is expected to be 4.2 million TEU.

Maritime transport data company MDS Transmodal estimates the value of rerouted cargo at around $105 billion.

U.S. shippers are also evaluating trans-Pacific shipping options and even looking at the Panama Canal as an alternative trade route. They are carefully analyzing the time and cost of these options to find the most suitable shipping method.

Although the pressure on transportation costs is inevitably passed on to consumers in the supply chain, whether it is air freight or detours, the cost will further increase.

On January 11, the Drewry World Container Index (WCI) experienced a significant rise of 15%, reaching $3,072 per feu compared to the previous week. Similarly, the Shanghai Containerized Freight Index (SCFI) saw a 16% increase, reaching 2206.03 points for the week ending on January 12.

The most substantial increases in the WCI were observed in the Asia-Europe/Med trades, which were directly affected by diversions from the Red Sea. Due to attacks by Houthi rebels, shipping in the region has faced challenges, leading to a shift towards the longer route around the Cape of Good Hope.

Specifically, freight rates from Shanghai to Genoa surged by 25% to $5,213 per feu, while rates for Shanghai to Rotterdam rose by 23% to $4,406 per feu, according to Drewry.

Given the ongoing situation in the Red Sea and Suez, Drewry anticipates further increases in East-West spot rates in the upcoming weeks.

Since the onset of the Red Sea crisis, the shipping industry has experienced uncertainties and price surges, prompting businesses to explore alternative transportation options. In this scenario, China-Europe railway transportation has emerged as a viable and advantageous choice.

The disruptions in sea shipping have led many customers to reconsider their reliance on traditional methods and turn towards the China-Europe freight trains. This shift has created new opportunities for cross-border road transport as well. Customers who previously relied on sea shipping have recognized the advantages of choosing the China-Europe railway as a reliable and efficient alternative.

Deng Guoliang, Vice President of Railway and Road Transport at CEVA Logistics Greater China has observed a significant increase in their China-Europe land freight volume since the Red Sea crisis. This surge indicates a growing preference for rail transportation among customers seeking flexibility and timeliness.

China-Europe railway transportation offers several benefits in the current context. First and foremost, it provides a more stable and secure route compared to sea shipping, which has been affected by the crisis. The railway network offers a reliable and efficient connection between China and Europe, ensuring smoother transit and minimizing the risk of delays or disruptions.

Additionally, China-Europe railway transportation offers greater flexibility in terms of cargo volume and type. Unlike the limitations imposed by sea shipping, railway transport can accommodate a wide range of goods, including perishable items, hazardous materials, and oversized cargo. This versatility appeals to businesses with diverse shipping requirements.

Moreover, the China-Europe railway route offers improved timeliness, ensuring faster delivery compared to sea transportation. While sea shipping can be subject to weather conditions and congestion, the railway provides a more predictable schedule, allowing businesses to better plan their supply chains and meet customer demands efficiently.

In conclusion, the Red Sea crisis has prompted businesses to explore alternative transportation options, with China-Europe railway transportation emerging as a favorable choice. With its stability, flexibility, and timely delivery, the China-Europe railway offers a reliable and efficient solution for businesses seeking to navigate the challenges posed by the current shipping uncertainties.

If you are interested in China import and export shipping services, please feel free to contact us.

Shawn.Liao(Mr.)

E-MAIL:sales04@viputrans.com

Phone/Wechat/Whatsapp/Skype: +8618926970495