Be your Logistics Department in China

Customized logistics solutions, your logistics expert in China

Customized logistics solutions, Shipping from China to the World

Tel:+8613424475220 Email:info@viputrans.com

How Trump's Reciprocal Tariffs Are Hitting the Global Economy?

Donald Trump announced an unprecedented tariff policy on April 2, 2025, marking a major shift in the global trade landscape. Invoking the International Emergency Economic Powers Act (IEEPA), Trump declared a national emergency "due to persistent and large U.S. merchandise trade deficits that raise national security and economic security concerns," and the first tariffs will be implemented within days. U.S. officials said the 10% base tariff will take effect at 12:01 a.m. on Saturday, April 5, while higher reciprocal tariffs will take effect at 12:01 a.m. on Thursday, April 9.

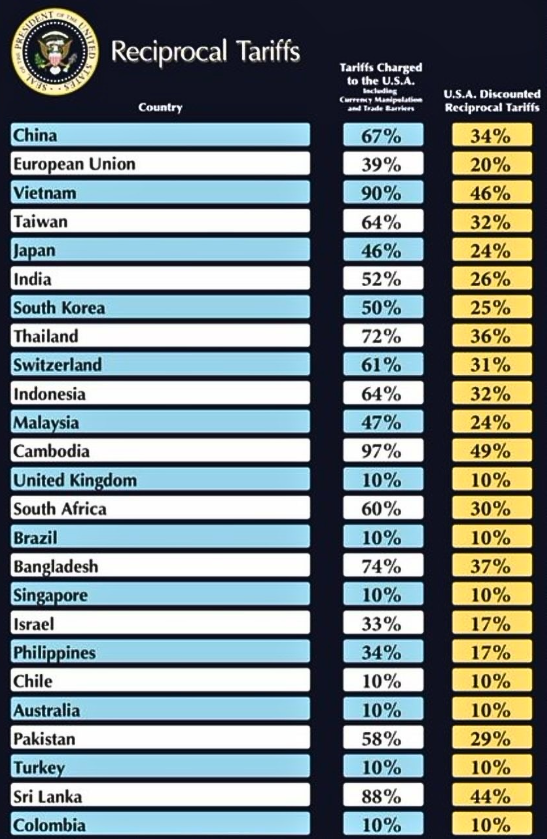

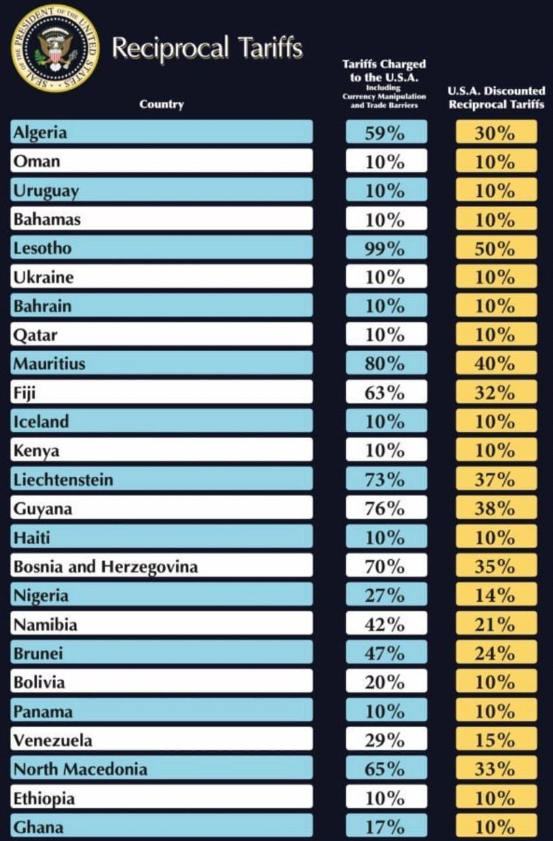

Trump called this day "Liberation Day", referring to the United States' tough stance in repositioning itself in the global economy. The tariff measures not only include a 10% base tariff on all imported goods, but also higher reciprocal tariffs ranging from 10% to 50% on 60 countries with the largest trade deficits with the United States. These tariffs will be imposed on top of existing tariffs. The specific tax rate will be calculated based on the total amount of tariffs and non-tariff barriers on US goods as determined by the White House Council of Economic Advisers, and half of the rate will apply to imports from these 60 countries. This decision is undoubtedly a continuation of Trump's long-standing "America First" policy, aimed at reducing trade deficits and promoting the reshoring of manufacturing.

Trump's tariff policy is particularly targeted at the European Union, China, Japan and several Southeast Asian countries, especially those with large trade deficits with the United States. Chinese imports will face a new 34% reciprocal tariff, while the European Union will be subject to a 20% tariff. At the same time, some other countries, especially major Southeast Asian exporters such as Vietnam and Cambodia, have tariff rates close to 50%. This series of measures is bound to bring huge shocks to the global supply chain and international trade, and may trigger a round of global retaliatory tariffs, further exacerbating global economic uncertainty.

Trump's tariff policy is not limited to commodity imports, but also extends to the cross-border e-commerce sector. In particular, the US decision to cancel the duty-free treatment of small packages from mainland China and Hong Kong will have a far-reaching impact on the global e-commerce ecosystem, especially posing a severe challenge to consumers and cross-border e-commerce platforms. This new rule is expected to take effect from May 2, further expanding the Trump administration's intervention in the economic field.

01

————————————————————

The game behind tariffs:

The starting point and path of Trump’s “tariffs to save the country”

Trump's obsession with tariffs

Donald Trump's tariff policy has long been a core part of his economic strategy. He once publicly said that "tariffs are the most beautiful word", which directly reflects his deep belief in tariffs as an economic tool. Trump believes that tariffs are not only an effective means to adjust the trade imbalance between the United States and other countries, but also the key to restore the US economic independence and revitalize the domestic manufacturing industry. In Trump's framework, tariffs are far more than a simple trade policy, but a powerful economic "killer weapon" that can force trading partners to make concessions to the United States by imposing tariffs on foreign countries.

Since Trump took office, he has continuously criticized the huge trade deficit between the United States and its major trading partners, especially China. He believes that this trade imbalance has directly weakened the industrial base of the United States, leading to the loss of American manufacturing and a reduction in job opportunities. Therefore, Trump regards tariffs as an important means to repair this economic imbalance and reshape the global competitiveness of the United States. In his view, tariffs are not just a simple trade tool, but also a strategic weapon for the United States to strengthen its negotiating position and promote economic independence.

Trump's tariff strategy is not limited to economic confrontation with "hostile" countries, but rather sees it as a way to compete with major economies around the world. In this process, tariff policy has become an important way for Trump to promote the United States' dominance in the global economy, aiming to protect American interests by forcing trading partners to lower barriers or make other concessions.

On February 25, the U.S. House of Representatives Budget Committee passed the Fiscal Year 2025 Budget Resolution, which plans to cut taxes by $4.5 trillion over the next decade, or about $450 billion per year. The U.S. Tax Foundation predicts that although the current tariff policy on China, Mexico, and Canada can increase tax revenue by about $142 billion per year, this is far from enough to make up for the fiscal gap caused by tax cuts. Therefore, the Trump administration will continue to expand the scope of tariffs and impose tariffs on more economies to further increase tax revenue. At the same time, Trump's tariff policy focuses on traditional manufacturing industries such as steel, aluminum, and automobiles, aiming to promote the return of jobs and industrial protection in the "Rust Belt" to consolidate its core voter base.

"Liberation Day": Trump's new tariff policy

On April 2, 2025, Trump announced that this day would be designated as "Liberation Day" and a new round of tariffs on imported goods would be implemented. The introduction of this policy marks Trump's further adjustment of the global trade order and also symbolizes the new positioning of the United States in the global economic competition. Trump has raised the tariff policy to an unprecedented level, bringing its tariff level to the level when the United States implemented the Smoot-Hawley Tariff Act during the Great Depression, which means that the global trade system has entered a new era full of uncertainty and competition.

Trump's tariff policy is not just an economic tool, but also a multi-dimensional diplomatic and strategic means. By imposing tariffs, Trump not only hopes to reduce the US trade deficit and restore the competitiveness of the US manufacturing industry, but also attempts to achieve the re-emergence of the US in the global economic system by changing the global economic rules and forcing other countries to make concessions. Trump's tariff policy deeply reflects his "America First" global economic strategy - in the context of increasing globalization, Trump hopes to gain more economic benefits and geopolitical advantages for the United States through unilateral actions.

Unlike traditional trade policies, Trump's tariff policy is clearly aggressive and has a clear "bargaining" nature. Through this policy, Trump has made it clear that he is not satisfied with the existing international economic order, especially when it comes to US interests, he is willing to use tough measures. This approach not only breaks the previous multilateral cooperation model, but also intensifies trade frictions around the world, bringing complex political and economic consequences.

Specific strategies for implementing the "new tariff policy"

Trump's new tariff policy is divided into two parts: one is to impose a 10% base tariff on all imported products, and the other is to implement higher "individualized reciprocal tariffs" for countries with the largest trade deficits with the United States. First, the 10% base tariff applies to imported goods from all countries in the world. This widely applicable tax rate is an important means for Trump to solve the trade deficit and stimulate the return of American manufacturing. By raising taxes on all imported goods, Trump intends to reduce the competitiveness of foreign goods in the US market, thereby promoting domestic production and employment.

Secondly, the Trump administration has implemented higher "individualized reciprocal tariffs" on the 60 countries with the largest trade deficits with the United States. The tariff rates for these countries will range from 10% to 50%, depending on the size of the bilateral trade deficit with the United States. This customized tariff policy has a strong economic "suppression" nature, forcing these countries to reassess their trade relations with the United States through high tariffs and make concessions in certain areas.

In particular, regarding China's tariff policy, Trump raised the tariff rate on Chinese goods to 34%, and increased it on the basis of the original 20% tariff. This measure has put Chinese exports to the United States under a 54% tariff pressure, which is obviously one of Trump's means of severely cracking down on China's trade policy. Trump's tariff policy on China is not only aimed at the trade deficit, but also involves disputes in key areas such as technology transfer and intellectual property protection, aiming to force China to make more economic and policy concessions.

In general, there are strong strategic goals behind Trump's tariff policies. These policies are not simply trade tools, but the US government's all-round strategic implementation of reshaping the global economic order, restoring economic independence, and conducting diplomatic negotiations through tough measures. Trump's use of tariffs has made it not only a weapon in trade games, but also a part of promoting the expansion of the United States' global influence.

02

————————————————————

"Liberation Day" opens a new era for the global economy:

A panoramic analysis of Trump's new tariff policy

Challenges to the global economic landscape

Trump’s tariff policy has accelerated the fragmentation of the global economy and changed the economic interactions between multinational corporations and countries. The increase in tariffs has led to a reassessment and adjustment of the global supply chain, especially as multinational corporations have had to move production and supply chains from traditional low-cost countries (especially China) to other low-tariff regions. Looking back at Trump’s first term, according to the World Bank, between 2018 and 2020, the tariffs imposed by the United States caused China’s exports to the United States to fall by about 16%, while US imports from China fell by 11%. As more and more production links move out of the United States, this policy directly interferes with the process of globalization and has a long-term negative impact on global cross-border investment.

In the process of Trump's tariff increase, the mutually beneficial and win-win situation brought about by globalization has been destroyed. The US manufacturing industry benefited greatly from globalization in the late 20th century, but with the increase in tariffs and the promotion of the "America First" strategy, globalization is facing a setback. This practice of the United States not only affects the efficiency of the global supply chain, but also increases the operating costs of countries and companies, and exacerbates the formation of trade barriers.The restructuring of the global industrial chain is no longer just an economic issue, it has become a political issue to some extent. In this tariff offensive launched by the United States, multinational companies and trading partners have to re-examine the resilience and stability of the supply chain. According to a study by McKinsey, about 30% of global manufacturing companies plan to move part of their production out of China in 2020, and some companies even seek to transfer production to other countries in Southeast Asia or South Asia, such as Vietnam, India and Bangladesh.

Many companies have begun to seek low-tariff production markets, and even a "de-Americanization" strategy has emerged, that is, avoiding the US market to reduce the cost burden brought by tariffs. For the global economy, this means that companies will no longer rely solely on the US market, but will accelerate regional economic cooperation and the development of domestic demand markets. According to a report by Deloitte, foreign investment inflows to countries such as Vietnam, India and Mexico increased significantly in 2020, partially replacing China's position in the global supply chain.

At the same time, many countries have also begun to examine how to reduce their dependence on the US market by strengthening economic cooperation with other countries. For example, the EU and China have strengthened their economic ties during this period, seeking to reduce economic pressure from the US. In the long run, this trend may accelerate the rise of regional economies, thus bringing more far-reaching impacts on globalization.

The transactional nature of Trump's tariff policy

Trump's tariff policy is not just an economic tool, it also has a strong diplomatic nature. By raising tariffs, Trump has exerted pressure on a global scale, forcing countries to make concessions in trade negotiations. This strategy not only requires countries to reduce or exempt tariffs, but may also require agreements on strategic cooperation, military deployment, etc. According to public data from the US government, during his first term, in negotiations between the United States and multiple economies such as China and the European Union, Trump successfully forced them to make concessions on some trade issues, including the European Union accepting tariff reductions on US goods in 2020 and China promising to increase purchases of US agricultural products in 2020.

Trump's transactional tariff policy, especially in China, Europe and other economies, shows his diplomatic strategy of maximizing benefits through tariff negotiations. By setting higher tariff standards, Trump can not only increase economic pressure, but also gain more strategic bargaining chips at the negotiation table. This strategy undoubtedly increases uncertainty in the international market, but also provides Trump with more strategic flexibility.

Trump's strategy in tariff negotiations is basically a kind of "art of deal". He uses tariffs as a negotiating tool and requires other countries to make certain concessions in exchange for tariff reductions or exemptions. For example, through negotiations, Trump requires economies such as the European Union and Canada to make concessions in military or diplomatic policies while reducing tariffs. This approach makes Trump's tariff policy not only affect trade negotiations at the economic level, but also closely related to international security and political issues.

However, this "art of deal" has also put other countries in a dilemma: on the one hand, they hope to obtain tariff exemptions through compromise, and on the other hand, this negotiation method forces them to consider more diplomatic factors in future trade exchanges. In the long run, this strategy may increase global economic uncertainty and trigger new trade frictions.

Domestic economic repercussions in the United States

Trump's tariff policy has put significant pressure on the domestic economy of the United States. Looking back at Trump's first term, according to the U.S. Bureau of Labor Statistics, the U.S. Consumer Price Index (CPI) increased by 2.3% in 2019, of which the rise in the price of imported goods caused by tariffs was an important reason. Tariffs directly pushed up the prices of many basic commodities, and consumers had to pay higher costs for them. Especially in the fields of daily consumer goods, auto parts, and electronic products, the increase in tariffs has made American families face higher purchasing costs. According to the U.S. Department of Commerce, in 2018 and 2019, the additional costs paid by American consumers due to tariffs were about $50 billion, especially low-income groups were more severely affected.

The U.S. labor market has also been affected. As companies face rising costs, some have begun to lay off employees or postpone investment, which in turn affects the stability of the job market. U.S. economists generally believe that these policies may increase the risk of long-term inflation in the United States, thus affecting the healthy development of the economy.

Although Trump's original intention in implementing the tariff policy was to protect the US manufacturing industry and stimulate domestic economic growth, in the long run, these measures may have the opposite effect. Back to Trump's first term, according to the International Monetary Fund (IMF), the US GDP growth rate fell from 2.4% in 2017 to 2.3% in 2019, and in 2020, due to the impact of the COVID-19 epidemic, the economic growth rate slowed further. With the rising cost of imported goods caused by the increase in tariffs, the production costs of enterprises are gradually increasing, and the risk of slowing overall economic growth is also increasing. Many companies that rely on imported raw materials, especially in the manufacturing sector, will face greater operating pressure, and the rising costs will eventually be passed on to consumers and the labor market.

Although the US trade deficit problem has been alleviated through tariffs, from a macroeconomic perspective, the long-term effect of the tariff policy may not be as expected. Faced with high tariffs, many companies may choose to outsource part of their production to other regions, or even "de-Americanize" to avoid the high tax burden of the US market. In this way, the return of manufacturing is not as strong as Trump hoped, but may lead to more structural challenges for the US economy in the short term.

03

————————————————————

The shocking moment of the global economy:

The multiple impacts of Trump's "new tariff policy"

Global Response Overview

The Trump administration’s tariff policy not only has a profound impact on the global economy, but also prompts countries to adopt diversified response measures. The subsequent reactions of all parties to this “new tariff policy” deserve our continued attention. Looking back at the responses of all parties to the US tariffs in the previous stage, we can make the following summary:

First, some economies have chosen to actively compromise or make concessions in exchange for tariff exemptions from the United States. India has cut import tariffs on American motorcycles and some whiskey products, and is considering reducing tariffs on other goods such as automobiles and chemicals. Israel announced on April 1 that it would cancel import tariffs on American goods, ensuring that all goods imported from the United States enjoy zero tariff treatment. These concessions are aimed at avoiding further confrontation with the United States and gaining economic benefits.

In contrast, other economies have chosen to counter the US tariff policy. The EU and Canada have retaliated against the US tariffs on steel and aluminum. On March 12, the EU announced that it would re-impose tariffs on US$8 billion worth of US goods and was considering further imposing the same measures on US$18 billion worth of US goods in the future. Canada also imposed a 25% tariff on US goods worth a total of 29.8 billion Canadian dollars on March 13. These countermeasures directly impacted US exports and reflected the determination of these economies in the tariff confrontation.

In addition, some countries have tried to resolve disputes through international mechanisms, although the Trump administration is likely to ignore international rulings. On March 4, Canada formally filed a complaint with the World Trade Organization (WTO), demanding the revocation of the US decision to impose additional tariffs. It is worth noting that the Trump administration has repeatedly failed to comply with WTO rulings and obstructed the appointment of judges to the WTO Appellate Body, making it unlikely for other countries to resolve disputes through the WTO. The WTO's lack of enforcement power makes the multilateral mechanism appear powerless in the face of US unilateralism.

At the same time, economies have accelerated regional cooperation to jointly respond to the US trade protection policy. China, Japan and South Korea resumed their first trade ministers' meeting in five years on March 30, announcing that they would strengthen cooperation under the framework of the Regional Comprehensive Economic Partnership (RCEP) and the WTO, and accelerate the negotiation of the China-Japan-South Korea Free Trade Agreement. This cooperation is not only a measure to respond to US trade pressure, but also a way to promote global economic diversification and reduce dependence on the US market.

Trump may adjust the implementation path of the tariff policy based on the reactions of various countries. Trump may exempt certain countries from the additional tariffs if they compromise. Considering the impact of tariffs on US agriculture, Trump reduced the tariff on potash fertilizer imported from Canada and Mexico from 25% to 10% on March 6. This move is aimed at reducing the burden on the agricultural sector and avoiding excessive impact on the domestic economy.

Trump may also further increase tariffs, especially against economies with strong countermeasures. On March 4, Trump decided to increase tariffs on all goods imported from China from 10% to 20%. This move has exacerbated Sino-US trade frictions and increased the complexity of future negotiations. Trump is expected to adjust tariffs in a timely manner based on the responses of various economies and may postpone the effective date of tariffs.

Splitting the traditional alliance system

Trump's tariff policy has significantly weakened the economic and strategic ties between the United States and its traditional allies. The long-term partnership between the European Union, Canada, Japan and other countries and the United States, especially the deep cooperation in the military and economic fields, faces huge challenges. By imposing tariffs, Trump forced these countries to take unilateral actions instead of relying on the multilateral trading system for negotiation. This not only exacerbated trade frictions, but also undermined long-standing trust and cooperation.

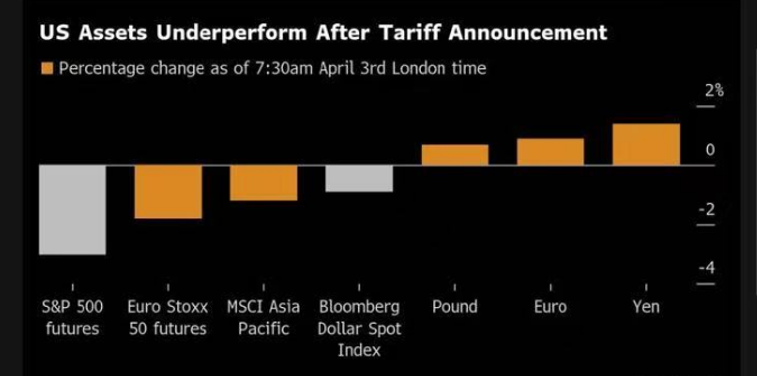

The tariffs imposed by the United States have had a profound impact on economies that rely on the US market. According to the World Economic Outlook report released by the OECD in March, the US tariff policy will lead to a shrinking of global trade, and global economic growth is expected to be reduced by 0.2 and 0.3 percentage points in 2025 and 2026, respectively, to 3.1% and 3.0%. Economies that rely heavily on exports to the United States, especially those that mainly export low-end goods, face a greater impact. Take Vietnam as an example. In 2024, exports to the United States accounted for 29.5% of its total exports, of which labor-intensive goods (such as furniture, toys, and clothing) accounted for about 40%. Because these goods have low profit margins and are easy to replace, the US tariffs will seriously affect Vietnam's exports, thereby hitting its economic growth. In the context of Sino-US trade frictions, many Chinese companies have transferred production to Vietnam, but the high tariffs imposed by the United States on Vietnam will slow down this trend and affect the pace of investment by Chinese companies in Vietnam. In addition, Mexico abolished its import tariffs on US corn after signing the North American Free Trade Agreement, but this has caused a shock to its local corn planting industry. Mexico's corn production is expected to drop to 23.3 million tons in 2024, the lowest level since 2014, and the corn planting area will also drop from 7.7 million hectares to more than 7 million hectares. According to the U.S. Department of Agriculture, Mexico will import 24 million tons of corn from the United States in 2024, accounting for more than 40% of its annual consumption. This change has brought significant pressure to the Mexican agricultural market.

In response to the previous tariff actions of the United States, the European Union and Canada have responded with retaliatory measures. After the United States imposed tariffs on its steel and aluminum products, the European Union immediately implemented a reciprocal tariff policy covering a number of American exports. Canada, on the other hand, imposed tariffs on billions of dollars worth of American goods and called for redefining its economic relationship with the United States in future trade negotiations. More importantly, these countries have gradually reduced their dependence on the US market and begun to increase economic cooperation with China and other emerging markets.

Fragmentation of global industrial chain and supply chain

The implementation of Trump's tariff policy has exacerbated the fragmentation trend of the global economy. The reorganization of the global supply chain has forced companies to re-examine the layout of production and procurement, and many multinational companies have to move their production bases from China and other high-tariff countries to low-tariff or tariff-exempt regions. This change has brought new challenges to companies, as the globalized and efficient supply chain is gradually replaced by regionalization and localization.

Countries such as Vietnam and India have become new manufacturing and export hubs, attracting a large amount of foreign investment and production lines. But this transfer is not without cost. Although Vietnam has lower labor costs, its infrastructure is still incomplete and its high-tech manufacturing capabilities are lacking compared to countries such as China. According to World Bank data in 2024, foreign direct investment (FDI) in Vietnam has increased by 15% in the past three years, indicating that Vietnam's manufacturing industry is developing rapidly. However, this trend also shows that companies will face greater pressure on global production efficiency and cost management, especially the surge in costs in cross-border logistics and supply chain management.

It is foreseeable that after the "new tariff policy" on April 2, global economic uncertainty will intensify again, and supply chain security may become an important consideration for corporate decision-making. Companies may further increase investment in localized or regionalized production and reduce dependence on global market fluctuations. In the long run, this shift may lead to an increase in global manufacturing costs and reduce the market competitiveness of products. The decline of globalization not only affects the efficiency of the supply chain, but may also increase the instability of international trade in the future.

China's industrial chain reconstruction and new position in the global supply chain

The US tariff policy will impact China's exports through multiple channels. It cannot be ignored that the shrinking global trade and weak import demand may drag down China's overall exports; as the US imposes tariffs on Mexico, Vietnam and other countries, it also increases the re-export trade costs of Chinese companies, increases the export costs of non-US regions, and compresses China's competitiveness in the global industrial chain; in addition, some economies may cooperate with the United States by imposing tariffs on China in exchange for tariff exemptions on its products, which will further increase the pressure on China's exports.

Although China is the main victim of Trump's tariff policy, this policy also provides China with an opportunity to accelerate the upgrading and reconstruction of its industrial chain. In order to cope with trade pressure from the United States, China is vigorously promoting the development of high-tech industries and gradually reducing its dependence on the US market by strengthening economic cooperation with Southeast Asian and African countries.

China's "Belt and Road" initiative has provided a strong impetus for this transformation, gradually reducing its dependence on the European and American markets through infrastructure construction and investment cooperation. According to a report from China's Ministry of Commerce, China's investment in countries along the "Belt and Road" has reached US$250 billion in 2024, accounting for more than 45% of its total foreign investment. This trend highlights China's strategic layout in the global economy. At the same time, China is accelerating the upgrading of high-end manufacturing, especially in the fields of semiconductors, artificial intelligence and new energy. By vigorously promoting innovation and technological research and development, China has gradually occupied a more critical position in the global industrial chain and has become a force that cannot be ignored in the global supply chain.

China's industrial chain reconstruction is not only reflected in the production field, but also in the efforts to strengthen scientific and technological innovation and the high-end development of the industrial chain. According to the "2024 Global Science and Technology Innovation Report", China's investment in 5G communication technology and new energy vehicles has increased by more than 20%, which has gradually enabled China to have a leading advantage in these fields. In addition, China's cooperation with Southeast Asian and African countries has strengthened its new position in the global manufacturing and resource supply chain, especially in energy and infrastructure construction, and promoted regional economic integration.

Although the current US tariff policy will have an impact on China's exports in the short term, China will gradually reduce its over-reliance on the US market by strengthening cooperation with other economies during the transformation process. This strategic adjustment will not only help China cope with US trade pressure, but also promote the diversified development of the global supply chain.

In any case, trade will not come to a complete halt. In the short term, affected by the wait-and-see mood, the shipper and consignee to re-calculate the cost, the shipment is inevitable to reduce, but I believe that the transportation demand will not become less, only transfer, if there is any transportation demand, please feel free to contact

Lora Yang E-mail: sales02@viputrans.com SKYPE|WECHAT|WHATSAPP|MOB:+86 13424468029

Copyright © 2003-2025 VIPU Supply Chain Logistics Co., Ltd. | All Rights Reserved

LOGISTICS | E-COMMERCIAL FULFILLMENT | ABOUT US | CASE | NEWS | VIDEO | CONTACT US

We will find the fastest or the cheapest way for your shipment. Please specify: where from, where to, what to ship.