Be your Logistics Department in China

Customized logistics solutions, your logistics expert in China

Customized logistics solutions, Shipping from China to the World

Tel:+8613424475220 Email:info@viputrans.com

What impact will the US’s additional tariffs on China have on the supply chain?

On February 1, 2025, the White House officially issued a trade announcement, announcing that new tariffs would be imposed on imports from Canada, Mexico, and China. The policy will take effect on February 4, 2025, which will have a significant impact on the exports of these countries and may trigger further international trade tensions.

According to a document released by the White House, starting from February 4, 2025, the United States will impose new tariffs on the following imported goods:

25% tariff on Mexican goods

This tariff applies to most imported goods from Mexico, including but not limited to agriculture, manufacturing and consumer goods. For companies that rely on Mexican production and supply, this policy will force them to readjust their supply chains to cope with the pressure of rising costs.

25% tariff on Canadian goods (excluding energy products)

Canadian goods will also face a 25% tariff, while energy products (such as oil, natural gas, etc.) will enjoy a lower 10% tariff. The US government's move is aimed at protecting domestic industries, especially those companies that import a large number of Canadian goods. It is worth noting that the exemption of energy products will ease the impact on the energy trade between the two countries.

10% tariff on Chinese goods

The United States will impose a 10% tariff on Chinese imports. This tariff covers a wide range of Chinese goods, especially electronic products, machinery and equipment, and consumer goods. For American companies that rely on Chinese production, costs will increase further, especially in the context of global supply chains that have been affected by previous tariffs.

Retaliation clause and potential impact

The tariff policy also includes a "retaliation clause"** According to this clause, if any affected country (such as Mexico, Canada or China) chooses to take retaliatory measures, the US government will consider further increasing tariffs or imposing other trade restrictions. This means that the current tariffs may just be the beginning, and future trade policies may continue to escalate and even trigger an intensification of international trade conflicts.

Special provisions: Tariff exemption for energy products

According to the Executive Order 14156 on the National Energy Emergency issued on January 20, 2025, the United States will impose a lower tariff rate of 10% on energy products from Canada (such as oil, natural gas and electricity). This policy reflects the United States' considerations in the field of energy security. Although the United States is implementing a broader tariff policy, considering the importance of energy resources, such products enjoy a more relaxed tariff treatment, aiming to protect the stability of energy trade between the two countries.

Effective time and transitional arrangements

With the implementation of the tariff policy officially released by the White House, the trade relations between the United States and Mexico, Canada and China will face major challenges. Enterprises, governments and related industries need to prepare for the implementation of tariffs as soon as possible and evaluate the cost changes and market reactions brought about by the new policies. Trade frictions and reactions in the coming months may further shape the future direction of the global economy.

VIPUTRANS believes that the flow of trade will only shift from one region to another. The supply chain may not abandon the existing infrastructure, and adjusting the import location will become an option to "make the situation less bad." In the future, Southeast Asia and India may become important markets for transshipment to the United States.

How do geopolitics cause supply chain shifts?

Global supply chains are fluid and constantly evolving in response to threats and opportunities. We saw this in 2018, during Trump’s first term, after the US-China trade war escalated. At the time, the US imposed tariffs on Chinese imports, prompting shippers to reconsider their options, such as importing to the US through Mexico and Canada. This drove a significant increase in twenty-foot equivalent unit (TEU) traffic from China to Mexico—a 76% increase between 2019 and 2024. TEU traffic to Canada grew 54% over the same period. Geopolitics may put up trade barriers, but ultimately, goods will always find a way to get from one place to another as long as there is demand.

Will shippers shift supply chains during Trump's next term?

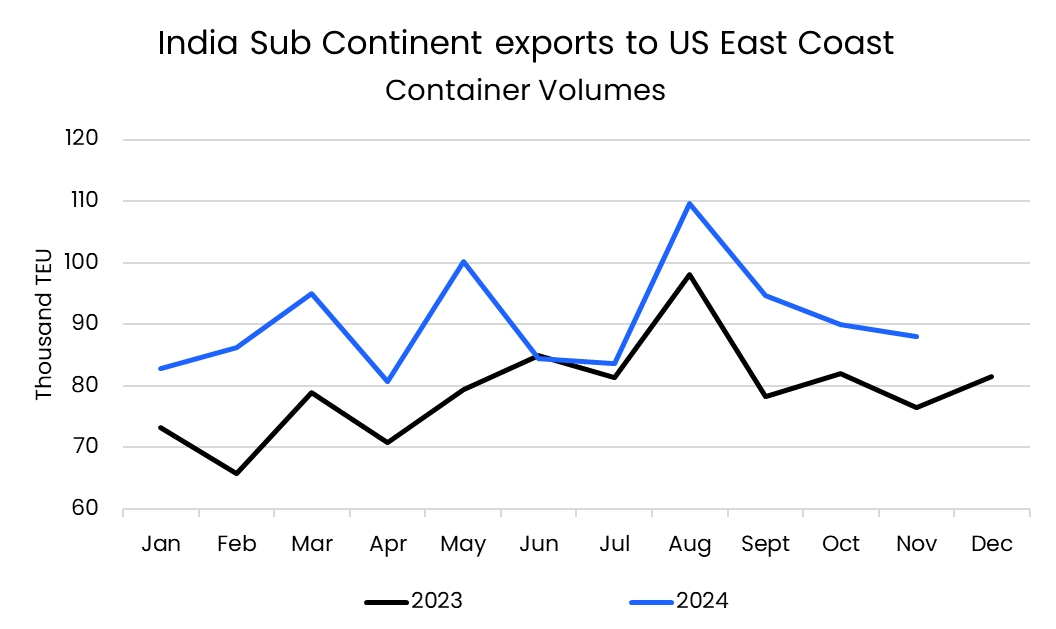

VIPUTRANS believes that shifting supply chains is a multi-million dollar question. After the United States imposed tariffs on Mexico and Canada, these two countries may no longer be a favorable backdoor into the United States, and the surge in shipping volume from China to Mexico and Canada may slow down. But shippers will not give up this channel easily, after all, they have spent years building and investing in infrastructure such as logistics centers. It should be noted that it is usually easier to adjust the import destination than to change the origin of exports. Importing goods to Mexico and then transshipping them to the United States will increase the complexity of the supply chain, but this complexity is insignificant compared to the huge changes brought about by not importing directly from China and closing the existing supply network. But it is still important to note that the number of containers exported from India has increased in recent years, mostly replacing China's exports. At the same time, the status of Southeast Asian neighbors such as Vietnam is also becoming increasingly prominent. In 2024, the volume of transportation from the Indian subcontinent to the East Coast of the United States increased by 14.5% year-on-year.

It is also possible that companies are trying to circumvent tariffs by shipping Chinese goods to countries such as Vietnam for repackaging or reprocessing before shipping them to the United States. This practice may accelerate if tariffs on China are further raised. With Trump set to impose a 10% tariff on Chinese imports on February 4, the Southeast Asian market may receive more goods from China. In addition, as an important node in the global supply chain, Southeast Asia will continue to attract more investment and cooperation from port and shipping companies.

What’s next?

VIPUTRANS believes we need to remain calm. It may take years for the trade landscape to evolve as different geopolitical threats emerge and recede. In four years, there may be a new president in the White House who has a different trade policy than Trump. Instead of waiting for threats like Trump’s tariffs to take action, shippers should have a deep understanding of ocean container shipping and flexible freight strategies to respond to these geopolitical power shifts in the short and long term.

The additional US tariffs on China will likely have several effects on China’s exports:

Higher tariffs make Chinese goods more expensive in the US market, potentially reducing demand. US importers may seek alternative suppliers from countries like Vietnam, India, or Mexico to avoid increased costs.

To counterbalance losses in the US market, China may redirect exports to other regions, such as Southeast Asia, Europe, Latin America, and Africa. This could accelerate China’s trade agreements and partnerships with non-Western economies.

Chinese exporters, especially in tariff-affected industries (e.g., electronics, machinery, and consumer goods), may experience declining orders. Some manufacturers might absorb part of the tariff cost to remain competitive, squeezing profit margins.

Some companies may move parts of their production outside China to avoid tariffs, leading to increased foreign direct investment in neighboring countries. However, China’s strong infrastructure and supply chain networks still provide competitive advantages.

The Chinese government might implement policies such as tax rebates or currency adjustments (Yuan depreciation) to support exporters and offset tariff impacts.

China may strengthen its domestic market and intra-Asia trade, leveraging agreements like the Regional Comprehensive Economic Partnership (RCEP) to boost regional exports.

While US tariffs create short-term challenges, China’s adaptability and strong trade networks will likely help mitigate long-term effects.

China's countermeasures against US tax increases

China has several potential countermeasures against the US’s tariff increases, which can be categorized into trade policy responses, economic adjustments, and geopolitical strategies:

China may impose reciprocal tariffs on US imports, targeting key industries such as agriculture (soybeans, corn), energy (LNG, crude oil), and automobiles to pressure US exporters.

· A 15% tariff will be imposed on coal and liquefied natural gas.

· A 10% tariff will be imposed on crude oil, agricultural machinery, large-displacement cars, and pickup trucks.

· For imported goods listed in the appendix originating from the United States, corresponding tariffs will be imposed on the basis of the current applicable tariff rates. The current bonded and tax reduction and exemption policies remain unchanged, and the additional tariffs will not be reduced or exempted.

· Expanding trade partnerships with Europe, Southeast Asia, Latin America, and the Middle East to reduce reliance on US markets.

· Enhancing Belt and Road Initiative (BRI) investments to boost exports to emerging economies.

· Strengthening RCEP (Regional Comprehensive Economic Partnership) and advancing China’s push for BRICS+ trade cooperation.

· Expanding "dual circulation" strategy, focusing on domestic demand to offset export losses.

· Investing in high-tech industries, semiconductors, and new energy sectors to reduce dependency on US technology.

· Supporting domestic innovation and subsidies for industries affected by tariffs.

· Depreciating the yuan (CNY) slightly to make exports more competitive.

· Using the Digital Yuan (e-CNY) and promoting the yuan in international trade to reduce reliance on the US dollar.

· Increasing Bilateral trade settlements in local currencies, such as with Russia, the Middle East, and ASEAN.

· Imposing stricter regulations on US companies operating in China, such as technology firms, finance, and consulting industries.

· Blacklisting certain US firms or restricting rare earth mineral exports, which are crucial for US tech and defense sectors.

· Tightening control over critical supply chains, such as batteries, electric vehicles, and raw materials.

· Strengthening ties with Europe, Middle Eastern energy suppliers, and Asian partners to reduce US leverage.

· Accelerating negotiations for free trade agreements (FTAs) with key regions, such as the EU and South America.

· Using WTO dispute mechanisms to challenge US tariffs as trade protectionism.

China is likely to take a multi-pronged approach, combining targeted retaliation, market diversification, domestic economic policies, and financial adjustments. While tariffs create short-term disruptions, China’s long-term strategy focuses on self-reliance, regional integration, and reducing dependence on US markets.

Although the tariffs imposed by the United States on China may have some impact on China's export transportation, VIPUTRANS is still very confident in export transportation, and we can also provide sea, air, rail and automobile transportation services from China to Asia and Europe. If you have any transportation needs, please feel free to contact us

Lora Yang E-mail: sales02@viputrans.com SKYPE|WECHAT|WHATSAPP|MOB:+86 13424468029

Copyright © 2003-2026 VIPU Supply Chain Logistics Co., Ltd. | All Rights Reserved

LOGISTICS | E-COMMERCIAL FULFILLMENT | ABOUT US | CASE | NEWS | VIDEO | CONTACT US

We will find the fastest or the cheapest way for your shipment. Please specify: where from, where to, what to ship.