The whole process of import and export trade of goods

1. Confirm order. Contract. Delivery date

Confirm order-confirm the price and quantity of the goods.

Confirm the contract-confirm the contract terms of the contract, the final shipment volume, the price of the goods, and the latest shipping date.

2. Notify the domestic agent and contact the freight forwarder

Notify the domestic agent and contact the domestic freight forwarder to prepare customs clearance documents.

Customs clearance documents: B/L, invoice, packing list, contract, certificate of origin, quality inspection certificate, packaging statement, etc. (documents need to be determined according to the specific product name, importing country, etc.)

3. Customs clearance process

Change order-go to freight forwarder or shipping company to change D/O. (According to the bill of lading to determine where to change the bill. H B/L forwarder bill of lading M B/L shipowner bill of lading)

Electronic declaration-computer pre-recording, document review, delivery, contact with customs/release.

Inspection declaration-After the electronic declaration is released, one of the four copies of the customs declaration form shall go to the Commodity Inspection Bureau to go through the quotation procedures, and the customs clearance form or the third inspection seal shall be issued.

On-site handover form-customs on-site handover form (please see the essence of this section for the required documents)

Inspection-Customs will conduct inspections based on the supervision conditions of the declared name of the goods and the inspection probability of the day. If there is an inspection, an inspection notice will be issued

Release-customs release has the following steps:

1. One time release

2. Issue an inspection notice or release 2 times without inspection

3. After inspection, release after customs.

4. Transport

Before transportation, pay attention to whether the Commodity Inspection Bureau issues a mobile sanitary inspection contact slip. If there is a health check, an appointment must be made half a working day in advance. The security inspection must be conducted, and the cost of evasion is between RMB 20,000 and 50,000 or the unit's qualification for inspection is suspended. The fleet needs to arrange the pick-up plan in the port area, such as: port area plan, tally, and put the box plan. The general situation is to schedule a plan 1 working day in advance.

5. Storage. Distribution

The consignee arranges warehousing, distribution and shipment after receiving the goods. Send the tax bill to the tax bureau to deduct VAT. Imported goods under customs supervision shall not be transferred within the supervision period. If transfer is required, it shall be declared to the customs again.

Basic procedure

declare:

1. The consignor of export goods shall, after preparing the export goods on time, quality and quantity in accordance with the provisions of the export contract, go through chartering and booking procedures with the transportation company, prepare to go through customs declaration formalities with the customs, or entrust professional (Agent) The customs declaration company handles customs declaration procedures.

2. Enterprises that need to entrust professional or agent declaration companies to go through customs declaration formalities, before exporting the goods, they should go through the entrusted declaration formalities with professional declaration companies or agent declaration companies at the nearest port of export. The professional customs declaration enterprise or the agent declaration enterprise that accepts the entrustment shall collect the formal declaration power of attorney from the entrusting unit, and the declaration power of attorney shall be subject to the format required by the customs.

3. Preparing the documents for customs declaration is the basis for ensuring the smooth customs clearance of exported goods. In general, the documents to be prepared for customs declarations, in addition to the export goods declaration form, mainly include: consignment note (ie delivery paper), one invoice, one trade contract, export receipt verification form and customs supervision conditions involved All kinds of documents.

Issues that should be paid attention to in declaration: Customs declaration time limit: Customs declaration time limit refers to the time limit for the consignor or its agent to declare to the customs after the goods are shipped to the port. The time limit for customs declaration of export goods is 24 hours before loading. For goods that do not need to be levied and inspected, customs clearance procedures shall be completed within one day after the declaration is accepted.

Inspection: Inspection refers to the fact that the customs accepts the declaration of the customs declaration unit and has already reviewed the declaration unit as a basis, through the actual verification of the export goods, to determine whether the content of the declaration document is consistent with the actual imported and exported goods Supervision method.

1. Verify that the content declared in the declaration link is consistent with the verified orders and goods by checking the actual goods and the customs declaration documents. Through the actual inspection, it is discovered whether there are any under-reporting, false declarations and non-declaration that cannot be found in the declaration and review process. Real and other issues.

2. Through the inspection, the doubts raised in the declaration and review link can be verified, and a reliable supervision basis can be provided for tax collection, statistics and follow-up management. After the customs inspects the goods, they must fill out an inspection record. The inspection record generally includes the inspection time, location, the name of the consignee or consignor of the import and export goods or their agent, the condition of the declared goods, the inspection of the transportation and packaging of the goods (such as the name of the means of transport, container number, size and seal number), and the goods The name, specification, model, etc. For goods that need to be inspected, an inspection notice will be issued within 1 day after the declaration is accepted, and the inspection will be completed within 1 day after the customs inspection conditions are met. In addition to tax payment, customs clearance procedures will be completed within 4 hours after the inspection is completed. Taxation: According to the relevant provisions of the 'Customs Law', import and export goods shall be subject to tariffs unless otherwise specified by the state. Duties are levied by the customs in accordance with customs import and export tariffs. For goods that need to be levied, a tax bill will be issued within 1 day of receipt of the declaration, and the customs clearance procedures will be completed within 2 hours of the tax bill payment.

Release:

1. For general export goods, after the consignor or its agent declares truthfully to the customs, and pays the tax and relevant fees in full, the customs affixes the 'Customs Release Seal' on the export shipping list. The consignor shall ship out of the country by shipment.

2. Customs return of exported goods: The consignor of the goods applying for return shall declare to the customs for the return within three days from the date of return, and the goods can be shipped out of the customs supervision place after the approval of the customs.

3. Issuing the export tax refund declaration form: After the customs releases it, the light yellow special export tax refund declaration form shall be stamped with the 'inspection seal' and the signature of the person in charge of the export tax refund who has been filed with the tax authority and returned to the customs declaration unit. In our country, about 150 million US dollars worth of goods are exported every day, and every day of delay in export verification and rebate, it will cause great losses to our customers. How to speed up the export tax rebate verification? The most important point in document operation is to fill in the export declaration form correctly. The relevant content of the customs declaration must be consistent with the content of the manifest sent to the customs by the shipping company to smoothly write off the tax refund. After the customs accepts the declaration and releases it, due to the stowage of the means of transport and other reasons, some of the goods cannot be loaded on the original declared means of transport, the export cargo shipper should submit the 'Export Goods Declaration Modification Application Form' to the customs in time and after correction Make corrections to the copy of the packing list, invoice and bill of lading so that the content on the customs declaration can be consistent with the content on the manifest.

The export goods process mainly includes: quotation, ordering, payment method, stocking, packaging, customs clearance procedures, shipment, transportation insurance, bill of lading, and foreign exchange settlement.

1. Quotation

In international trade, inquiries and quotations of products are generally used as the beginning of trade. Among them, the quotation for export products mainly includes: product quality level, product specifications and models, whether the product has special packaging requirements, the quantity of products purchased, delivery requirements, product transportation methods, product materials, etc. .

The more commonly used quotations are: FOB 'Delivery on Board', CNF 'Cost and Freight', CIF 'Cost, Insurance and Freight' and other forms.

2. Order (signature)

After both parties of the trade have reached an agreement on the quotation, the buyer’s company will formally place an order and negotiate with the seller’s company on some related matters. After the two parties have negotiated and approved, a 'purchase contract' is required. In the process of signing the 'Purchase Contract', the main items are the name of the product, specifications, quantity, price, packaging, place of production, shipping period, payment terms, settlement methods, claims, arbitration, etc., and the agreement will be reached after the negotiation. Written into the 'purchase contract'. This marked the official start of the export business. Under normal circumstances, two copies of the purchase contract shall be effective by both parties with the official seal of the company, and each party shall keep one copy.

Three, payment method

There are three commonly used international payment methods, namely, letter of credit payment, TT payment and direct payment. 1. Payment method of letter of credit

Letters of credit are divided into two types: clean letter of credit and documentary letter of credit. Documentary credit refers to a letter of credit with designated documents, and a letter of credit without any documents is called a clean letter of credit. Simply put, a letter of credit is a guarantee document that guarantees the exporter to recover the payment. Please note that the shipment period of exported goods should be within the validity period of the letter of credit, and the deadline for presentation of the letter of credit must be submitted no later than the validity date of the letter of credit.

In international trade, letters of credit are mostly used as payment methods, and the date of issuance of the letter of credit should be clear, clear and complete. Several state-owned commercial banks in China, such as Bank of China, China Construction Bank, Agricultural Bank of China, Industrial and Commercial Bank of China, etc., are able to issue letters of credit (the issuing fees of these major banks are 1.5 of the issuing amount). ‰).

2. TT payment method

The TT payment method is settled in foreign exchange cash. Your customer will remit the money to the foreign exchange bank account designated by your company. You can request the remittance within a certain period of time after the goods arrive.

3. Direct payment method

Refers to the direct delivery and payment by the buyer and the seller.

Fourth, stock up

Stocking plays an important role in the entire trade process and must be implemented one by one in accordance with the contract. The main check contents of stocking are as follows:

1. The quality and specifications of the goods shall be verified according to the requirements of the contract.

2. Quantity of goods: guarantee to meet the quantity requirements of the contract or letter of credit.

3. Stocking time: According to the provisions of the letter of credit, combined with the shipping schedule to facilitate cargo connection.

Five, packaging

You can choose the packaging form according to the different goods (such as: carton, wooden box, woven bag, etc.). Different packaging forms have different packaging requirements.

1. General export packaging standards: packaging according to the general standards for trade and export.

2. Special export packaging standards: export goods packaging according to customers' special requirements.

3. The packaging and markings of the goods (transportation marks): careful inspection and verification should be carried out to make them comply with the provisions of the letter of credit.

6. Customs clearance procedures

The customs clearance procedures are extremely cumbersome and extremely important. If the customs clearance cannot be completed successfully, the transaction cannot be completed.

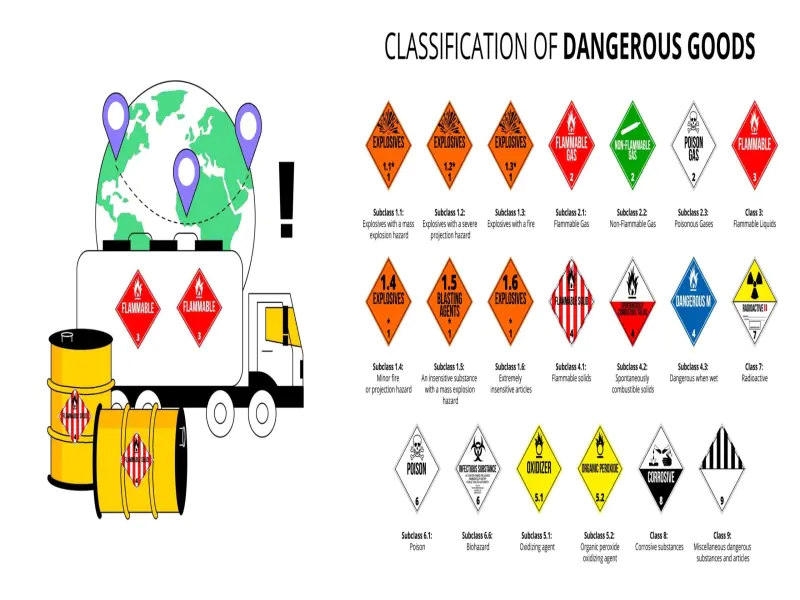

1. Export commodities subject to statutory inspection must be issued with an export commodity inspection certificate.

At present, my country's import and export commodity inspection mainly has four links:

Acceptance of inspection: The application of inspection means that the person concerned with foreign trade applies for inspection to the commodity inspection agency.

Sampling: After the commodity inspection agency accepts the application for inspection, it shall promptly dispatch personnel to the cargo storage location for on-site inspection and identification.

Inspection: After the commodity inspection agency accepts the application for inspection, it will carefully study the declared inspection items and determine the inspection content. And carefully review the contract (letter of credit) stipulations on quality, specifications, and packaging, clarify the basis for the inspection, and determine the inspection standards and methods. (Inspection methods include sampling inspection, instrument analysis inspection, physical inspection, sensory inspection, microbiological inspection, etc.)

Issuing a certificate: In terms of export, all the export commodities listed in the 'Category List' shall be issued a release form (or a release form shall be stamped on the 'Export Goods Declaration Form' to replace the release form) after passing the inspection by the commodity inspection agency.

2. A professional person holding a customs declaration certificate must go to the customs for customs clearance procedures with the packing list, invoice, customs declaration letter of attorney, export settlement verification form, a copy of the export goods contract, and the export goods inspection certificate.

The packing list is the packing details of export products provided by the exporter.

The invoice is a certificate of export product provided by the exporter.

Customs declaration power of attorney is a certificate issued by a unit or individual who does not have the ability to declare customs to entrust a customs broker to declare.

The export verification form is applied by the exporting unit to the foreign exchange bureau, and refers to a document used by an export-capable unit to obtain an export tax refund.

Commodity inspection certificate is obtained after passing the inspection of the entry-exit inspection and quarantine department or its designated inspection agency. It is the collective term for various import and export commodity inspection certificates, identification certificates and other certificates. It is a valid document with legal basis for the fulfillment of contractual obligations by parties involved in foreign trade, settlement of claims, disputes, arbitration, and litigation. It is also a necessary proof for customs inspection and release, tariff collection and preferential tariff reduction.