Be your Logistics Department in China

Customized logistics solutions, your logistics expert in China

Customized logistics solutions, Shipping from China to the World

Tel:+8613424475220 Email:info@viputrans.com

Notification of exporting to India

India is the largest country in the South Asian subcontinent, with a large number of domestic ports. There are 12 major ports, including Mumbai, Calcutta, Chennai (formerly Madras), Cochin, Goa, etc., which bear 3 / 4 of the freight volume. Among them, the port of Mumbai is the largest port, and its shipping capacity ranks 18th in the world.

China's sea transportation to Calcutta port in India needs to transit through other ports, and the voyage is about 14-21 days. Transit ports include Colombo / Visakhapatnam / krishnapatnam / Port Klang / Singapore and other ports.

India's import and export by sea involves the following documents:

1)Signed invoice

2)Packing list

3)Sea bill of lading or bill of lading/air waybill

4)Completed GATT declaration form

5)Declaration form of the importer or its customs agent

6)Approval documents (if necessary)

7)Letter of credit/bank draft (if required)

8)Insurance documents

9)Import license

10) Industry license (if required)

11)Test report (provided when the goods are chemicals)

12) Temporary exemption order

13)Certificate of exemption from tariff (DEEC) / original Certificate of tax rebate and tax reduction (DEPB)

14)Contents, detailed technical specifications and relevant documents (provided when the goods are mechanical equipment, mechanical equipment parts or chemicals)

15)Single price of mechanical equipment parts

16)Certificate of origin (provided when preferential tariff rate is applicable)

17)Statement of no commission

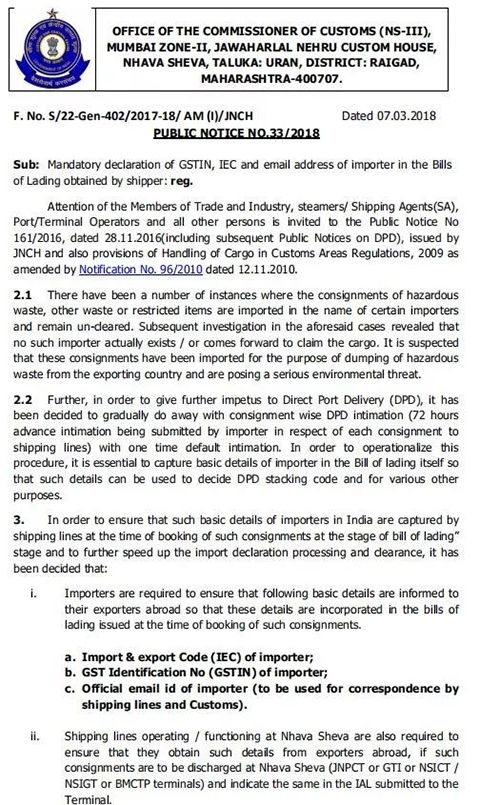

The Directorate General of Customs of India has issued proclamation No. 33 / 2018, which stipulates that as of April 1, 2018, importers must ensure that their exporters are informed of the following basic details abroad in order to include them in the booking of such goods:

(1)importer's import and export code (IEC)

(2)Consumption tax importer ID number (GSTIN)

(3)official email ID of the importer (for shipping lines and communication with customs)

The notice is issued in case of the consignment of hazardous wastes, import of other wastes or restricted articles in the name of some importers and not cleared. Therefore, the basic information of the importer must be recorded on the bill of lading so that this basic information can be used to determine DPD stacking and other various purposes.

From July 1, 2017, India will integrate its various local service taxes into goods and services tax (GST), which will also replace the previously announced 15% Indian service tax. GST will be charged at 18% of the import and export Indian service charges, including local charges such as terminal handling charges and inland transportation charges.

On September 26, 2018, the Indian government suddenly announced to raise import tariffs on 19 "unnecessary goods" to reduce the growing current account deficit. The tariff adjustment raised tariffs on imported goods such as air conditioners, refrigerators, washing machines, footwear, loudspeakers, jewelry, some plastic products, suitcases, and aviation turbine fuel.

India's Ministry of Finance has notified that import tariffs on 17 commodities will be increased from October 12, 2018. These 17 commodities include smartwatches, telecommunication equipment, etc. According to the notice, tariffs on smartwatches and telecommunications equipment have been raised from the current 10% to 20%.

First of all, all goods transferred to the inland freight station in India must be transported by the shipping company, and the final destination column of the bill of lading and manifest must be filled as the inland point. Otherwise, it must be unloaded at the port or pay a high fee for changing the manifest before it can be transferred inland.

Secondly, the goods can be stored in the customs warehouse for 30 days after arrival. After 30 days, the customs will send the notice of delivery to the importer. If the importer is unable to pick up the goods on time for some reason, he may apply to the customs for the extension as required. If the Indian buyer does not apply for an extension, the exporter's goods will be auctioned after 30 days' storage at customs

After unloading (generally within 3 days), the importer or his agent shall fill in the bill of entry in quadruplicate. The first and second copies shall be kept by the customs, the third by the importer, and the fourth by the bank where the importer pays the tax. Otherwise, a high detention fee shall be paid to the harbor bureau or airport authority.

If the goods are declared through the EDI system, it is not necessary to fill in the paper import declaration form, but it is necessary to enter the detailed information required by the customs in the computer system for handling the application for customs clearance of goods, and the EDI system will automatically generate the import declaration form.

(1)Bill of lading

For the goods of POD in India, the consignee and the Notifying Party must be in India and have a detailed name, address, telephone, fax. The description of the goods must be complete and accurate; free time clause is not allowed to be shown on the bill of lading,

For the goods of POD in India, the consignee and the Notifying Party must be in India and have a detailed name, address, telephone, fax. The description of the goods must be complete and accurate; the free time clause is not allowed to be.

Copyright © 2003-2026 VIPU Supply Chain Logistics Co., Ltd. | All Rights Reserved

LOGISTICS | E-COMMERCIAL FULFILLMENT | ABOUT US | CASE | NEWS | VIDEO | CONTACT US

We will find the fastest or the cheapest way for your shipment. Please specify: where from, where to, what to ship.