Be your Logistics Department in China

Customized logistics solutions, your logistics expert in China

Customized logistics solutions, Shipping from China to the World

Tel:+8613424475220 Email:info@viputrans.com

In international trade, there are special terms used to make sure everyone understands who is responsible for what when it comes to shipping goods. These terms help avoid confusion and make sure both the buyer and the seller know their responsibilities. Let’s break down some of these terms using simple words.

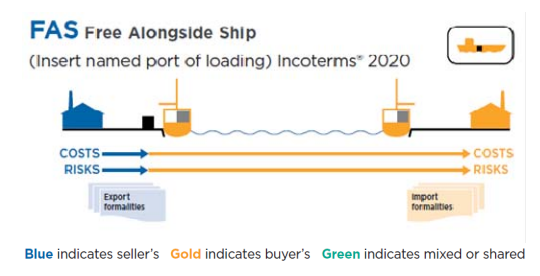

Meaning: The seller brings the goods to the side of the ship at the port. After that, the buyer is responsible for them.

Costs for Seller:

Transporting the goods to the port.

Costs for Buyer:

Loading the goods onto the ship.

Paying for the ship’s journey.

Insurance for the goods during the journey.

Unloading and transporting the goods to the final destination.

Risk: The risk of damage or loss transfers to the buyer once the goods are next to the ship.

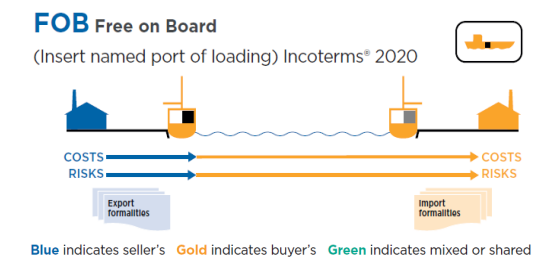

Meaning: The seller loads the goods onto the ship. After that, the buyer is responsible.

Costs for Seller:

Bringing the goods to the port.

Loading them onto the ship.

Costs for Buyer:

Paying for the ship’s journey.

Insurance for the goods during the journey.

Unloading and transporting the goods to the final destination.

Risk: The risk of damage or loss transfers to the buyer once the goods are on the ship.

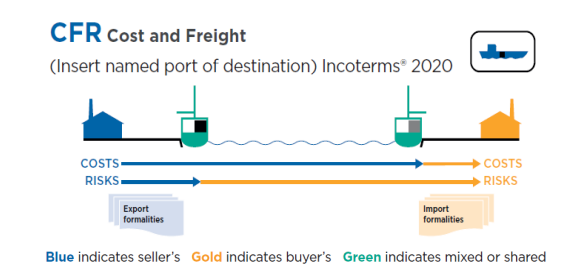

Meaning: The seller pays for transporting the goods to the port and loading them onto the ship. The buyer handles them once they are on the ship.

Costs for Seller:

Transporting the goods to the port.

Paying for the ship’s journey.

Costs for Buyer:

Insurance for the goods during the journey.

Unloading and transporting the goods to the final destination.

Risk: The risk of damage or loss transfers to the buyer once the goods are on the ship.

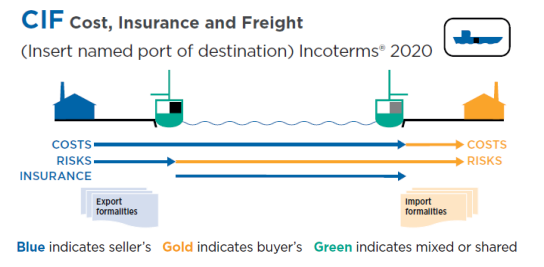

Meaning: Similar to CFR, but the seller also pays for insurance during the journey.

Costs for Seller:

Transporting the goods to the port.

Paying for the ship’s journey.

Insurance for the goods during the journey.

Costs for Buyer:

Unloading and transporting the goods to the final destination.

Risk: The risk of damage or loss transfers to the buyer once the goods are on the ship, but the seller’s insurance covers the journey.

Using these terms helps both the seller and the buyer understand who pays for what and when the risk moves from one to the other. This way, there are fewer arguments and problems during international trade. The latest set of these rules is called Incoterms® 2020, which makes things even clearer for everyone involved.

When trading goods, it’s important to use the right term to avoid misunderstandings and ensure a smooth transaction. Always make sure to specify which version of the Incoterms you are using in your contracts.

When people trade goods internationally, they include these terms in their contracts. This way, both the seller and the buyer know exactly what they are responsible for and when their responsibility ends. Let’s look more closely at some additional details.

Responsibility: The seller’s job ends when the goods are next to the ship. From there, the buyer takes over.

Export Clearance: The seller must clear the goods for export, meaning they handle all the paperwork and fees needed to send the goods out of the country.

Insurance: The buyer decides whether to buy insurance for the goods during the journey. The seller does not provide it.

Responsibility: The seller must load the goods onto the ship. Once the goods are on the ship, the buyer is responsible.

Export Clearance: Like FAS, the seller clears the goods for export.

Insurance: The buyer arranges for insurance if they want it. The seller does not provide it.

Responsibility: The seller pays for the transport of the goods to the destination port but does not cover insurance. The buyer takes over once the goods are on the ship.

Export Clearance: The seller handles this.

Insurance: The buyer can choose to insure the goods. The seller is not responsible for insurance.

Responsibility: The seller pays for both the transport and insurance to the destination port. The buyer takes over once the goods are on the ship.

Export Clearance: Handled by the seller.

Insurance: The seller buys insurance to cover the goods during the journey. The buyer benefits from this insurance.

When deciding which term to use, think about who you want to handle certain tasks and costs. Here’s a simple way to decide:

FAS is good if the buyer wants to handle more of the shipping process and costs.

FOB is useful if the seller is okay with taking care of loading the goods onto the ship.

CFR is best if the seller will handle transport but the buyer will handle insurance.

CIF is suitable if the seller will handle both transport and insurance, making it easier for the buyer.

Imagine you are buying grain from another country. If you choose FOB, the seller will deliver the grain to the ship and load it. Once the grain is on the ship, you take over. You will pay for the shipping, insurance, and unloading costs. If you choose CIF, the seller will take care of everything until the grain arrives at your port, including insurance.

These shipping terms help make international trade clearer and more organized. By understanding FAS, FOB, CFR, and CIF, you can better manage your responsibilities and costs when buying or selling goods internationally. Always make sure to specify which term you are using in your contracts to avoid any misunderstandings.

Imagine you are buying grain from another country. If you choose FOB, the seller will deliver the grain to the ship and load it. Once the grain is on the ship, you take over. You will pay for the shipping, insurance, and unloading costs. If you choose CIF, the seller will take care of everything until the grain arrives at your port, including insurance.

These shipping terms help make international trade clearer and more organized. By understanding FAS, FOB, CFR, and CIF, you can better manage your responsibilities and costs when buying or selling goods internationally. Always make sure to specify which term you are using in your contracts to avoid any misunderstandings.

Copyright © 2003-2025 VIPU Supply Chain Logistics Co., Ltd. | All Rights Reserved

LOGISTICS | E-COMMERCIAL FULFILLMENT | ABOUT US | CASE | NEWS | VIDEO | CONTACT US

We will find the fastest or the cheapest way for your shipment. Please specify: where from, where to, what to ship.