Basic customs procedures for import and export goods

Customs clearance means that the consignees and consignees of inbound and outbound goods and their agents, the owners of inbound and outbound goods, and the person in charge of inbound and outbound transportation shall go through the import and export formalities with the customs, and the customs shall submit the relevant entry and exit documents and applications for entry. The whole process of reviewing, inspecting, collecting taxes and fees, and approving import and export of goods, transportation and articles leaving the country in accordance with the law.

Basic customs clearance procedures for general inbound and outbound goods

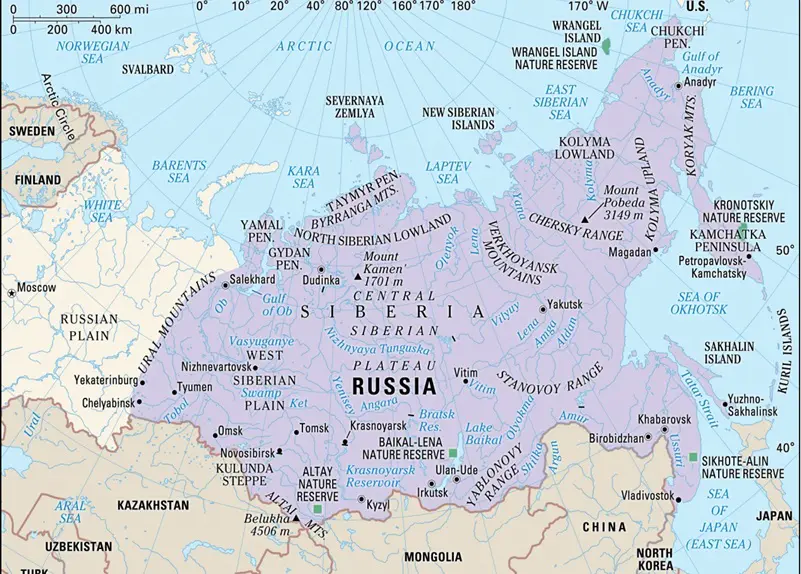

The procedures for customs clearance of import and export goods can basically be divided into four steps: declaration, inspection, taxation, and release. The basic procedures of customs clearance can be roughly represented by the following table.

1. Declaration of Import and Export Goods

What the customs broker should do:

1. Fill in the customs declaration form for import and export goods;

2. Provide legal documents, such as import and export goods license, inspection and quarantine certificate;

3. Attach shipping and commercial documents, such as packing list, commercial and bill of lading;

4. Tax reduction and exemption, certification exemption. File a declaration

What the customs should do:

1. Carry out number registration, endorsement of declaration date and binding of customs declaration form;

2. Review the contents of the declaration form (preliminary review and review). Accept declaration

2. Inspection of import and export goods

What the customs broker should do:

1. Send personnel to inspect the goods with the customs;

2. Responsible for moving, unpacking and restoring after inspection. Accept inspection

What the customs should do:

1. Check whether the orders are consistent;

2. Check outside the supervision zone and collect fees from the customs declaration unit;

3. During inspection, if the goods are damaged, compensation should be paid to the customs declaration unit. Inspect goods

3. Taxation of Import and Export Goods

What the customs broker should do:

1. Respond to or provide any questions or required documents from the customs taxation department at any time;

2. Pay customs and domestic taxes at the designated bank with the payment notice issued by the customs. Pay taxes

What the customs should do:

1. Price review

2. Calculate and levy tariffs and reduce or exempt them according to relevant tax rates

3. Issue a bank payment slip. Levy taxes

4. Release of import and export goods

What the customs broker should do:

1. Obtain the release form and other return documents with the customs declaration certificate and receipt evidence;

2. Pick up or load the goods and depart from the customs-supervised warehouse. Pick up by voucher or ship out

What the customs should do:

1. Check whether the duties and fees are paid;

2. Check whether the attached documents are written off;

3. Check whether the various customs clearance procedures are completed and whether there are any omissions;

4. The handler stamps the release seal on the customs declaration form and the bill of lading. Clearance and release